Introduction

FintechZoom Simple Mortgage Calculator: Ever wondered how people buy houses? Well, they often use something called a mortgage. And guess what? There’s this excellent tool called a mortgage calculator that can help you figure out how much you need to pay each month if you borrow money to buy a house. This guide is here to break it all down for you!

What is FintechZoom?

Introducing FintechZoom

FintechZoom is a super intelligent website that helps people with their money. These fantastic tools and calculators can help you understand all sorts of financial things, like loans and mortgages.

Services Provided by FintechZoom

FintechZoom offers several services, including calculators for various types of loans, financial news, and even tips to help you manage your money better.

Understanding Mortgages

What is a Mortgage?

A mortgage is a particular loan that people use to buy a house. When you get a mortgage, you promise to pay back the money you borrowed over a certain number of years.

How Mortgages Work

Here’s how it goes: You borrow money from a bank and agree to pay it back little by little every month, usually for a really long time. Oh, and don’t forget, you also have to pay extra money called interest, which is like a fee for borrowing money.

Why Use a Mortgage Calculator?

The Benefits of a Mortgage Calculator

A mortgage calculator is super handy because it helps you figure out how much you need to pay each month if you borrow money to buy a house. It saves you a ton of time and makes all the math stuff rasy.

Savieasyime and Effort

Instead of doing all the math independently, you can use a mortgage calculator to get all the answers quickly and easily.

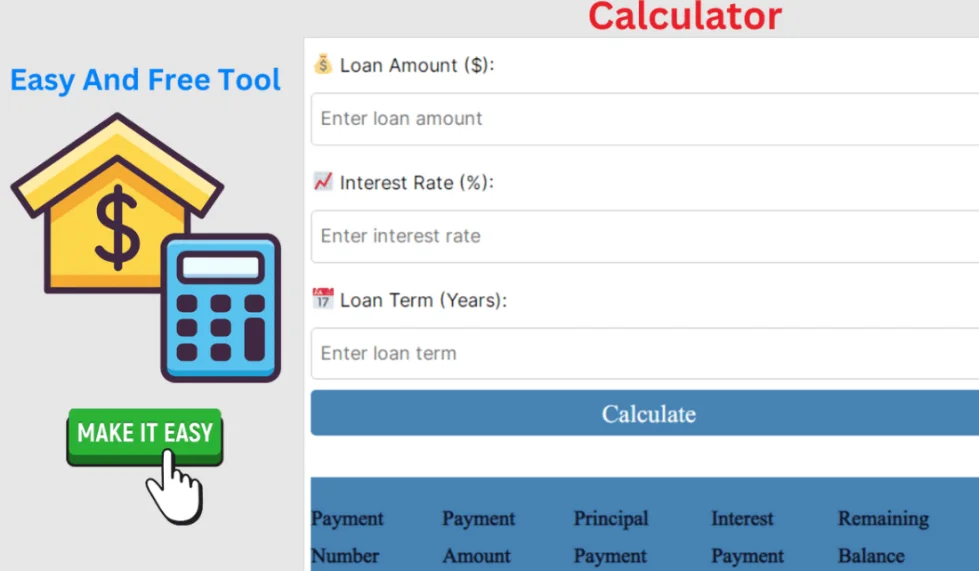

Features of the FintechZoom Simple Mortgage Calculator

Easy to Use

The FintechZoom Simple Mortgage Calculator is designed to be user-friendly. Even if you’re not a computer whiz, you’ll find it easy to navigate.

Accurate Calculations

This calculator gives you the correct numbers, so you’ll know exactly what to expect when you borrow money for a house.

How to Use the FintechZoom Simple Mortgage Calculator

Step-by-Step Guide

First, go to the FintechZoom website using your internet browser.

Next, find the mortgage calculator tool on the website.

Then, input details like the amount you want to borrow, the interest rate, and the number of years to pay it back.

After that, the calculator will display your monthly payment amount.

Entering Your Information

Remember to input the correct numbers for:

- The loan amount you want to borrow

- The interest rate

- The loan term in years

Understanding the Results

Monthly Payments

The calculator will show you the monthly payment amount to help you determine if you can afford the loan.

Total Interest Paid

It also calculates the total interest you will pay over the loan’s life.

Loan Payoff Date

If you make all your payments on time, you’ll find out when you’ll finish paying off the loan.

Factors Affecting Mortgage Calculations

Interest Rates

Higher interest rates mean higher monthly payments as they represent the cost of borrowing money.

Loan Term

Shorter loan terms lead to higher monthly payments but less total interest paid.

Down Payment

A larger down payment means borrowing less money, which can reduce monthly payments.

Practical Examples

Example 1: Small Loan with a Short Term

For instance, borrowing $50,000 for 10 years at 5% interest will show you the monthly payment and total interest.

Example 2: Large Loan with a Long Term

On the other hand, borrowing $300,000 for 30 years at the same interest rate will display different monthly payments and total interest.

Tips for Using the Mortgage Calculator Effectively

- Check Your Numbers Twice

Always make sure you’ve entered the correct numbers to get the most accurate results.

- Explore Different Scenarios

Adjust the loan amount, interest rate, and loan term to see how your monthly payment changes.

Common Mistakes to Avoid

- Don’t Forget Additional Costs

Remember, there are other expenses when buying a house, such as taxes and insurance. Make sure to include them in your calculations.

- Use the Right Interest Rate

Make sure you use the current interest rate. Using the wrong rate will give you inaccurate results.

Benefits of Planning with a Mortgage Calculator

- Plan Your Budget

Knowing your monthly payment helps you plan your budget. You’ll better know how much money you need to set aside each month.

- Understand Your Financial Commitments

Using a mortgage calculator gives you a bigger picture of your financial situation and helps you understand how long you’ll pay off your loan.

Real-Life Applications

- Buying Your First Home

If you’re purchasing your first home, a mortgage calculator can help determine how much house you can afford.

- Refinancing Your Mortgage

You might consider refinancing to get a better deal if you already have a mortgage. A mortgage calculator can help you determine whether it’s worth it.

FAQs About Mortgage Calculators

- What is a mortgage calculator?

A mortgage calculator is a tool for calculating monthly payments if you borrow money to buy a house.

- Why should I use a mortgage calculator?

Using a mortgage calculator saves you time and gives you a better understanding of your financial situation.

- How do I find the interest rate?

You can get the current interest rate from your bank or look it up online.

- Can I use the calculator for any loan?

You can use the calculator for any mortgage loan to determine your monthly payments.

- What if the interest rate changes?

If the interest rate changes, you can update the calculator with the new rate to see how it affects your payments.

In Closing:

The FintechZoom mortgage calculator is a great tool to determine how much you’ll pay each month and the total cost of buying a house. It’s simple to use, preipretendand can save you a bunch of time and energy. So, if you’re getting ready to buy your first home or considering refinancing, check out the FintechZoom Simple Mortgage Calculator!

Reviews About FintechZoom mortgage calculator:

5 Stars: Review by Mark T.

“This calculator is great! It helped me understand how much I can afford to borrow and what my monthly payments will be. The only reason I’m not giving it 5 stars is that it could use a bit more explanation for beginners. Otherwise, it’s fantastic.”

5 Stars: Review by Emily R.

“Using the FintechZoom Simple Mortgage Calculator saved me hours of doing the math myself. I entered my loan details, and it gave me a clear picture of my financial future. It’s a must-have tool for anyone looking at mortgages.”